Last year we bought the worst house in the best neighborhood in Northern Colorado. We knew buying a fixer upper home would come with challenges. As handy DIY’ers, we thought we were ready for them. One year later, I’m looking back at what I wished we’d done different in the home-buying process. Things that would have saved us $15,000’s+ dollars and a lot of stress!

Buying A Fixer Upper Home: Our 90’s Abandoned, Hoarder Home

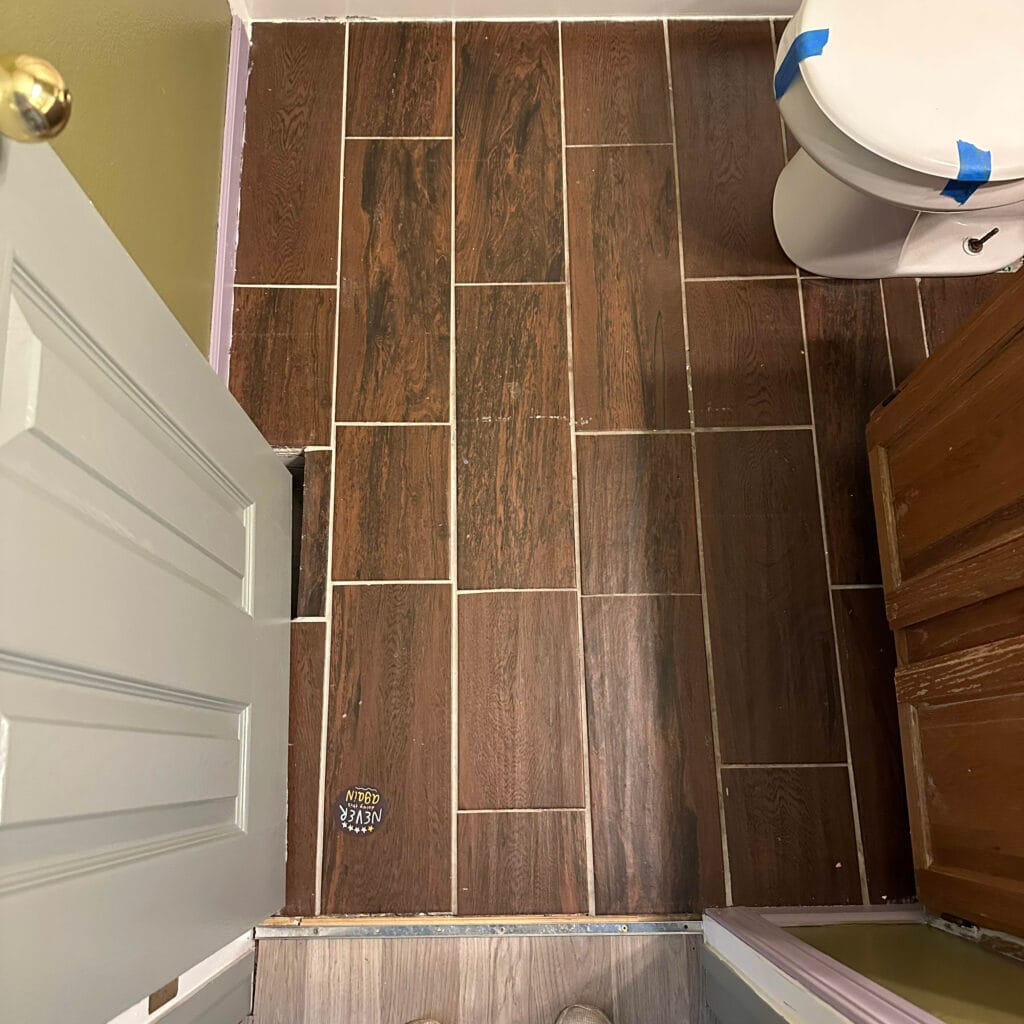

This was our home the week we moved in. Inside and outside, the house needed a lot of cosmetic work. Almost everything needs replaced from either damage or poor quality installation: flooring, doors, trim, lighting, cabinets, windows, the deck, and the list goes on.

(Still can’t believe someone thought this looked good…)

This was the state of the backyard a few months before we bought it. No trees, no grass, and tons of garbage.

Like anyone buying a fixer upper, we looked past all this and saw so much potential. We fell in love with this house because of the neighborhood, the proximity to the mountains, and the price. We knew it would take a lot of work, but if we could do it, we’d live here for a long time.

It checked the important boxes of a forever home for us, ironically enough. So we took it.

Realities of buying a fixer upper home

Things went bad fast.

The day we moved in, our basement was flooded with water. Upstairs, our feet were turning black from the dirty floors. All the sinks were leaking, a handful of appliances were broken, and I discovered a major foundation issue our inspector had missed. Plus so much more.

In a few month’s time, instead of doing the fun projects we had been dreaming off, we were drowning in pressing projects just to make this house at minimum, functional.

Part of this is the reality of buying a home, especially a fixer upper. You never truly know what you’re getting into.

But there are a few things I would do differently next time in the home-buying process to mitigate the financial burden and stress we’ve experienced with buying a fixer upper home.

1. Ask for seller’s concessions.

Our sellers did not disclose any known issues. Obviously we knew this didn’t mean there weren’t issues because we could see tons of major cosmetic problems just from our brief walkthrough.

However, we overlooked this and declined to ask for concessions for updates/repairs when it came down to it.

We are handy, we wanted to do the work ourselves, and honestly we were just so grateful they picked our offer out of the competition.

Looking back, I see that we were in a position to ask for some steep concessions. Buying a fixer upper home, one that’s been hoarded and abandoned too (we found out later), is a risk.

Not disclosing any issues was a red flag, and we should have taken advantage of the opportunity to bring the price down some. I wish we had thought through the fact that the home was sitting unoccupied, and therefore probably wasn’t being maintained well. Surely there were hidden problems.

Asking for even a few $1,000’s in concessions for obvious issues (like the bad flooring, broken doors, and poor trim work) would have made a world of difference for us in the first year here.

After your home inspection, look through what items would be worth requesting concessions for. They may decline, but it’s worth negotiating for.

2. Request a home warranty.

In the first three months of living here, we had to fix the washer, dryer, AC, dishwasher, and stove. These all passed our home inspection and we assumed there’d be no issues.

After two appliances broke in the first month, we considered getting our own home warrantly, but the monthly price and the extended time for it to kick in just didn’t make sense as everything broke at once. Next time, we’ll ask the seller’s to cover the cost of a home warranty on our behalf. It would have saved us a lot of headache and money!

3. Hire a structural engineer & plumber before closing.

Top of my must-have list our new home was “good bones”. As long as it’s structurally sound, we can deal with the cosmetic stuff later.

NEVER AGAIN will I skip this step in the home buying process!! We trusted our home inspector to let us know if there were any structural or plumbing issues. Our basement is unfinished so the house framing below and basement walls are visible. We also paid for a main drain line scope.

All were good to go and clear, we were told.

However, we’ve since learned that home inspectors are not experts at all things.

Our home inspector missed a leaning foundation wall in our basement (which I found 2 weeks after moving in). He failed to find and disclose this to us, and we ended up paying $14,000 out of pocket 6 months later for a foundation repair.

If we had gone a little slower and spent a little extra in the purchase process to hire a structural engineer before closing, we could have caught this and not had to take out another loan after just buying a house.

(Since sharing this story, many of you have told me horror stories of hidden, expensive plumbing issues discovered after purchasing a new home. It made me realize how important this step is as well!)

4. Hire an insured home inspector you trust.

I know I just mentioned our bad experience with our home inspector, but this deserves it’s own point. Our home inspector missed a lot, it turns out.

Get a recommendation, read reviews, and ask questions

Since we were moving to a completely new area, we hired this person on a recommendation from our realtor. They seemed experienced and legit, and thorough in their inspection. He was helpful as he shared his report to us over the phone. We trusted this person to give us the honest truth about the state of this home, which we were worried about. Buying a fixer upper home is a risk and we needed this person’s help.

It wasn’t until a month later that we learned he hadn’t been as thorough as we thought. I pulled up his hiring contract to look at the details of what our rights where in this situation, what an inspector is legally obligated to report on, and tried to figure out how to move forward. It was a stressful mess I wish we could have avoided.

Next time I hire a home inspector, I’ll ask them:

- “What if we move in and notice you may have missed something?”

- “Do you have insurance to cover the cost of something you may have missed?“

- “Have you ever filed an insurance claim for something you missed?”

- “Is there a window of time we’d need to report any issues to you?”

I would tell them our experience in this house, and see what they’d do differently.

Review Their Contract Before Signing

I would look through the fine print of their hiring contract for details on reporting missed items, what they will be looking for in the inspection, and liability details. Know what you are signing, and know your legal rights.

Truthfully, we may have had a legal case against our home inspector. In Colorado, inspectors are obligated to report on structural issues, and this one was pretty obvious. We didn’t feel he adequately informed us of this visible foundation problem. But in their contract, we had to report any issues within 30 days and that deadline had already passed. I asked them to come take a look at it still, and he ended up refunding us our inspection fee but that was it.

As a non-confrontrational person, I wish I’d had a more direct conversation with him about his liablity in this situation. Instead, we just went forward with fixing it on our own.

Next time, I will vet our home inspector much more. Your new home is an major investment. Protect it as best you can!

5. View the house in person more than once.

Between my husband and I, I am the visionary one. He is the practical one. So on our one and only walk-through of this house, I was absolutely blind to any cosmetic problems. I just knew in my soul this was the house for us, and that we could fix any existing cosmetic issue, no problem.

Viewing it more than once would have let me see past my grand, long-term visions, and really view the cringy details of what we were about to buy.

It would have helped me set better expectations as to what our first year in this house would entail.

Since we lived across the country, we only got to see this house once. But I wish we had extended our visit or bought another plane ticket at the last minute to see it one more time.

6. If the house is empty, ask how long it’s been unocccupied.

No brainer, right? Well, we did consider this at all.

After moving in, we learned from neighbors that it had been sitting empty for over a year. This would have been a major red flag for us.

Homes that sit unoccupied most likely aren’t being maintained. When issues (leaks, broken AC, regular cleaning, etc.) arrise, like in any home, they might not get addressed.

Additionally, homes that have been rented usually are not maintained well either. Renters don’t take care of a home in the same way a homeowner would. And landlords aren’t present or attentive like a homeowner is either. These can be indications of hidden problems you’ll need to take care of.

Questions to ask the seller’s:

- Has this house ever been rented?

- How long has it been empty?

- Has someone been living here consistently?

If we had known our home had been abandoned for a year, we would have asked for a home warranty, seller’s concessions, or lowered our offer. To cover our butt’s with any extra maintenance cost moving forward.

7. Look for maintenance records on major appliances.

This is something you can ask your home inspector to check or look for during the viewing. Is there a record of when the AC or furnace was last maintained? This is usually written on the appliance.

You can also ask the sellers about the age of all the appliances included to know when you might need to replace them. A year from now, or 5 years from now?

We assumed the washer and dryer that came with the house were new based on their style, but it turns out they are 7 years old and on their last legs. We learned this after a mechanic came to fix them a month after moving in.

If these records or answers are hard to find or don’t exist, tread with caution. Ask for a home warranty that would cover any potential major appliance issues. Hire a specialist to double check the AC/HVAC, furnace, water heater, etc. are working properly, as those can be a expensive repairs.

8. Set lower expections for your project timelines.

Buying a fixer upper home doesn’t always go according to plan. The house may involve more work and money than you expected or were ready for.

I am a visionary person through-and-through. I think you need to be when buying a fixer upper home. When I close my eyes, I can see our bathrooms remodeled, our kitchen expanded, our flooring redone, etc. It’s incredibly gorgeous. And we had lofty plans to replace furniture, update our floors, and finish our basement as soon as we moved in.

But reality sunk in fast with a lot of unexpected hiccups. I know we’ll eventually get to all our dream updates, but we just need to go a lot slower with projects than I’d hoped.

Until we can pay off our foundation and scrape up some extra money for bigger projects, our focus is on updating what we can on a small budget.

Mentally and financially prepare yourself for the unexpected as best you can!

Through all of this, I’m so grateful we picked a home we knew have forever home potential. So although we’re itching to be updating this house, we know every project is an investment into our future here.

Every project we accomplish from now on is a breath of new energy into this home and into our daily life here. We’ll eventually get to it all.

Buying a fixer upper home is scary at times. I hope our story will help you with yours! And may get you a better headstart on creating your dream home.